what is a good cap rate xlp

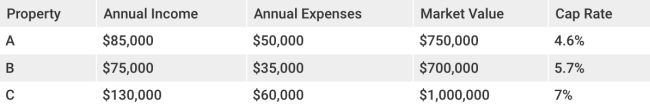

The cap rate you desire when purchasing an investment property is important. Higher cap rates are better for your annual return. The cap rate should determine whether you plan to make at least a specific percentage of your investment income each year. To determine the price for a particular property, you can divide your calculated net profit figure by your target cap rate.